Do you need to file a Self Assessment tax return for 2017/18?

Self Assessment Tax is a complex and ever changing area in which a tax payer tells HMRC about their income. Paper tax returns have to be submitted to HMRC by the 31st October following the end of the tax year whilst online returns are due 31st January following the end of the tax year. Preparing even the most straightforward tax return can be complicated. We can take the worry away! We will complete your tax return, calculate your tax liability and file online as your agent.

Early Bird Discounts are available for bringing your information in earlier! Not only will you pay a reduced fee, but also get more advance notice of any tax liability or more time to spend a tax refund!

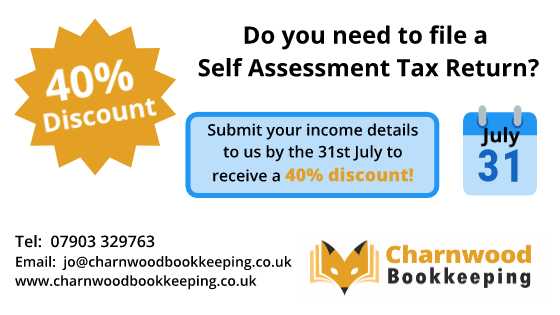

Get our very best early bird discount! Submit your income details to us by the 31st July to receive a 40% discount. Contact us now and don’t miss out.

Find out more about our Self Assessment tax services and the savings to be made.